Het 2016 McClean Report dat later deze week verschijnt bevat een top 50 van bedrijven gerangschikt op omzet behaald met halfgeleiders en chips. Daaruit blijkt dat TSMC ruim vijf keer groter is dan nummer twee Globalfoundries en het afgelopen jaar en omzetgroei beleefd te hebben van 6 procent. Maar ook komt naar voren dat die omzet veel minder sterk gestegen is dan het jaar ervoor en dat de stijging van het werk voor Apple met 1,99 miljard dollar de totale groei van 1,46 miljard dollar ruim overtreft. Zonder Apple zou de omzet van nummer 1 met 2 procent gedaald zijn.

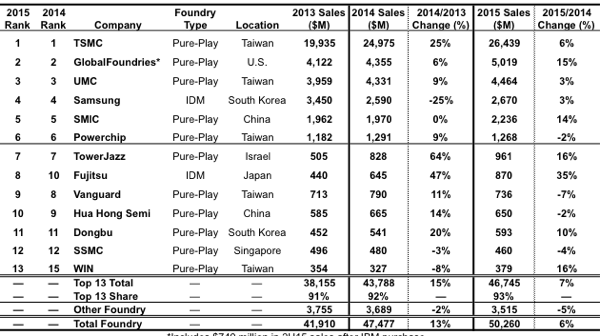

TSMC, by far, was the leader with $26.4 billion in sales last year. In fact, TSMC’s 2015 sales were over 5x that of second-ranked GlobalFoundries (even with the addition of IBM’s chip business in the second half of 2015) and almost 12x the sales of the fifth-ranked China-based foundry SMIC. As shown, there are only two IDM foundries in the ranking—Samsung and Fujitsu—after IBM and Magnachip fell from the list in 2015. Despite losing a significant amount of Apple’s business, Samsung easily remained the largest IDM foundry last year, with more than 3x the sales of Fujitsu, the second-largest IDM foundry.

Illustrating the dramatic effect of exchange rate fluctuations on the IC sales numbers, TSMC’s 2015 growth rate was about half (6%) of what it was in its local currency (11%). Thus, while the company met its stated goal of 10% or better growth in 2015 in NT dollars (840.5 billion), its growth rate in U.S. dollars was only 6%.

Driving home just how important Apple’s foundry business is, TSMC’s foundry sales increased by $1,464 million last year while its sales to Apple jumped by $1,990 million, representing more than 100% of TSMC’s total foundry sales increase in 2015. As a result, without Apple, TSMC’s foundry sales would have declined by 2% last year, eight points less than the 6% increase it logged when including Apple.

Second ranked GlobalFoundries took over IBM’s IC business in early July of 2015. It should be noted that besides $515 million in IDM foundry sales IBM made in 2014, the company also had about $1.0 billion of internal transfer IC revenue that year. As a result, GlobalFoundries’ quarterly sales in 4Q15 were about $1.4 billion, an annual run-rate of $5.6 billion, about 12% greater than the company’s 2015 sales of $5.0 billion. However, without the addition of IBM’s sales in the second half of last year, GlobalFoundries’ sales would have declined by 2% in 2015.

Sales from the top 13 foundries’ shown in Figure 1 were $46.7 billion and represented 93% of the $50.3 billion in total foundry sales in 2015. This share was two points higher than the 91% share the top 13 represented two years earlier in 2013. With the barriers to entry (e.g., fab costs, access to leading edge technology, etc.) into the foundry business being so high and rising, IC Insights expects this “top 13” marketshare figure to continue to slowly rise in the future.